Porter's Five Forces Framework

The essence of strategy is choosing what not to do. - Michael Porter

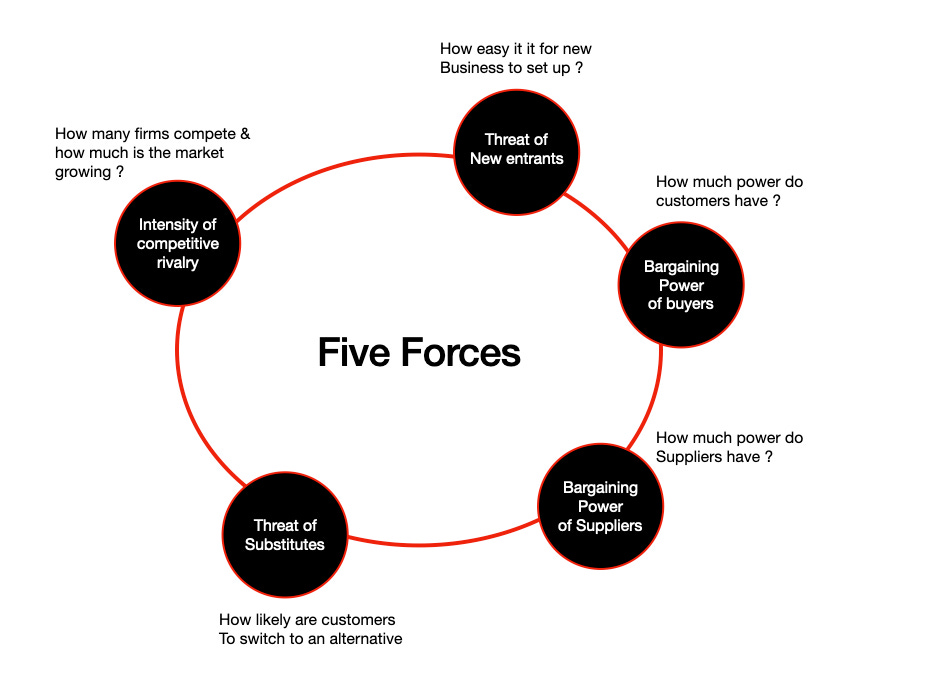

What is Porter’s five forces

Porter’s Five Forces is a simple but powerful tool for understanding the competitiveness of your product, and for identifying your strategy’s potential profitability. It helps you with product strategy & roadmap planning.

Understanding Porter's Five Forces

Porter's Five Forces is a business analysis model that helps to explain why various industries are able to sustain different levels of profitability. The model was published in Michael E. Porter's book, "Competitive Strategy: Techniques for Analyzing Industries and Competitors" in 1980.1

The Five Forces model is widely used to analyze the industry structure of a company as well as its corporate strategy. Porter identified five undeniable forces that play a part in shaping every market and industry in the world,with some caveats. The five forces are frequently used to measure competition intensity, attractiveness, and profitability of an industry or market.

The threat of New Entry. Your position can be affected by people’s ability to enter your market. So, think about how easily this could be done.

The threat of Substitution. This refers to the likelihood of your customers finding a different way of doing what you do.

Supplier Power. This is determined by how easy it is for your suppliers to increase their prices.

Buyer Power. How easy it is for buyers to drive your prices down.

Competitive Rivalry: This looks at the number and strength of your competitors.

By thinking about how each force affects you, and by identifying its strength and direction, you can quickly assess your product position in the market. You can then look at what strategic changes you need to make to deliver long-term profit.

1) Threat of new entrants

New entrants put pressure on current organizations within an industry through their desire to gain market share. This in turn puts pressure on prices, costs, and the rate of investment needed to sustain a business within the industry. The threat of new entrants is particularly intense if they are diversifying from another market as they can leverage existing expertise, cash flow, and brand identity as it puts a strain on existing companies' profitability.

Barriers to entry restrict the threat of new entrants. If the barriers are high, the threat of new entrants is reduced and conversely if the barriers are low, the risk of new companies venturing into a given market is high. Barriers to entry are advantages that existing, established companies have over new entrants.

Michael E. Porter differentiates two factors which can have an effect on how much of a threat new entrants may pose:

Barriers to entry The most attractive segment is one in which entry barriers are high and exit barriers are low. It is worth noting, however, that high barriers to entry almost always make exit more difficult.Michael E. Porter lists 7 major sources of entry barriers:

Supply-side economies of scale – spreading the fixed costs over a larger volume of units thus reducing the cost per unit. This can discourage a new entrant because they either have to start trading at a smaller volume of unit and accept a price disadvantage over larger companies, or risk coming into the market on a large scale in an attempt to displace the existing market leader.

Demand-side benefits of scale – this occurs when a buyers willingness to purchase a particular product or service increases with other people's willingness to purchase it. Also known as network effect, people tend to value being in a 'network' with a larger number of people who use the same company.

Customer switching costs – These are well illustrated by structural market characteristics such as supply chain integration but also can be created by firms. Airline frequent flyer programs are an example.

Capital requirements – clearly the Internet has influenced this factor dramatically. Websites and apps can be launched cheaply and easily as opposed to the brick-and-mortar industries of the past.

Incumbency advantages independent of size (e.g., customer loyalty and brand equity).

Unequal access to distribution channels – if there are a limited number of distribution channels for a certain product/service, new entrants may struggle to find a retail or wholesale channel to sell through as existing competitors will have a claim on them.

Government policy such as sanctioned monopolies, legal franchise requirements, patents, and regulatory requirements.

2) Threat of substitutes

A substitute product uses a different technology to try to solve the same economic need. Examples of substitutes are meat, poultry, and fish; landlines and cellular telephones; airlines, automobiles, trains, and ships; beer and wine; and so on. For example, tap water is a substitute for Coke, but Pepsi is a product that uses the same technology (albeit different ingredients) to compete head-to-head with Coke, so it is not a substitute. Increased marketing for drinking tap water might "shrink the pie" for both Coke and Pepsi, whereas increased Pepsi advertising would likely "grow the pie" (increase consumption of all soft drinks), while giving Pepsi a larger market share at Coke's expense.

Potential factors:

Buyer propensity to substitute. This aspect incorporated both tangible and intangible factors. Brand loyalty can be very important as in the Coke and Pepsi example above; however contractual and legal barriers are also effective.

Relative price performance of substitute

Buyer's switching costs. This factor is well illustrated by the mobility industry. Uber and its many competitors took advantage of the incumbent taxi industry's dependence on legal barriers to entry and when those fell away, it was trivial for customers to switch. There were no costs as every transaction was atomic, with no incentive for customers not to try another product.

Perceived level of product differentiation which is classic Michael Porter in the sense that there are only two basic mechanisms for competition – lowest price or differentiation. Developing multiple products for niche markets is one way to mitigate this factor.

Number of substitute products available in the market

Ease of substitution

3) Bargaining power of customers

The bargaining power of customers is also described as the market of outputs: the ability of customers to put the firm under pressure, which also affects the customer's sensitivity to price changes. Firms can take measures to reduce buyer power, such as implementing a loyalty program. Buyers' power is high if buyers have many alternatives. It is low if they have few choices.

Potential factors:

Buyer concentration to firm concentration ratio

Degree of dependency upon existing channels of distribution

Bargaining leverage, particularly in industries with high fixed costs

Buyer switching costs

Buyer information availability

Availability of existing substitute products

Buyer price sensitivity

Differential advantage (uniqueness) of industry products

RFM (customer value) Analysis

4) Bargaining power of suppliers

The bargaining power of suppliers is also described as the market of inputs. Suppliers of raw materials, components, labor, and services (such as expertise) to the firm can be a source of power over the firm when there are few substitutes. If you are making biscuits and there is only one person who sells flour, you have no alternative but to buy it from them. Suppliers may refuse to work with the firm or charge excessively high prices for unique resources.

Potential factors are:

Supplier switching costs relative to firm switching costs

Degree of differentiation of inputs

Impact of inputs on cost and differentiation

Presence of substitute inputs

Strength of distribution channel

Supplier concentration to firm concentration ratio

Employee solidarity (e.g. labor unions)

Supplier competition: the ability to forward vertically integrate and cut out the buyer.

5) Competitive rivalry

For most industries the intensity of competitive rivalry is the biggest determinant of the competitiveness of the industry. Having an understanding of industry rivals is vital to successfully marketing a product. Positioning depends on how the public perceives a product and distinguishes it from that of competitors. An organization must be aware of its competitors' marketing strategies and pricing and also be reactive to any changes made. Rivalry among competitors tends to be cutthroat and industry profitability low while having the potential factors below:

Potential factors:

Sustainable competitive advantage through innovation

Competition between online and offline organizations

Level of advertising expense

Powerful competitive strategy which could potentially be realized by adhering to Porter's work on low cost versus differentiation.

Firm concentration ratio

How to Use Porter's Five Forces Model

Porter's Five Forces Model can help you to analyze the attractiveness of a particularly industry, assess investment options, and measure competition intensity.

To use the model, start by looking at each of the five forces in turn, and how they apply in your industry. Ask yourself the following questions:

Is rivalry between competitors intense or do you tend to retain customers relatively easily?

Do you have lots of suppliers to choose from or do you rely heavily on a small group of suppliers?

Is buyer power high or low?

Would buyers find it easy to substitute your product or service?

Do new competitors find it easy to enter the market or is it difficult?

After you've considered these questions, write down each of the five forces, and summarize the size and scale of each using your findings. An easy way of doing this is to use a single "+" sign for a force that's moderately in your favor, or a "-" sign for a force that's moderately against you. Use "++" for a force that's strongly in your favor, or "--" for one that's strongly against. For a neutral force, you can use "o."

Finally, think about how your analysis will likely impact you. Bear in mind that few situations are perfect – but analyzing your industry using Porter's Five Forces can help you to think through what you could change to improve your competitive position and increase your profitability.

What's more, if you find yourself in a structurally weak position, the model can help you to think about what you can do to move into a stronger one.