Berkus Product Valuation Method

Pre-revenue, I do not trust projections, even discounted projections.” — Dave Berkus

What is Product valuation?

Product valuation is the process of calculating the financial value of a company or a product. The valuation involves collecting and analyzing a range of metrics, such as revenue, profits, and losses, as well as the risks and opportunities a product faces. The goal is to arrive at a company’s estimated intrinsic value and enable product managers and stakeholders to make informed purchase, sale, or investment decisions.

There are several methods used to determine the value of a business. There are three main types of valuations you should know about when it comes to small businesses or “Main Street” businesses.

Seller’s Discretionary Earnings (SDE) – probably the most common approach and one an owner may be able to do on their own.

Discounted Cash Flow (DCF) – is more common for businesses that generate more than $2,000,000 in annual revenue and is performed by a financial analyst with experience in this methodology.

Net Asset Valuation (NAV) is used when the value of assets may be worth as much or more than the business itself or if a business owner is seeking to wind down and dissolve a product.

The Berkus method calculates company value before their first revenue. In the 1990s, Dave Berkus first developed this method. He is a well-known angel investor and venture capitalist in the US. Let us study more about Berkus's method of valuation and learn about it in-depth.

What is Berkus's method of valuation?

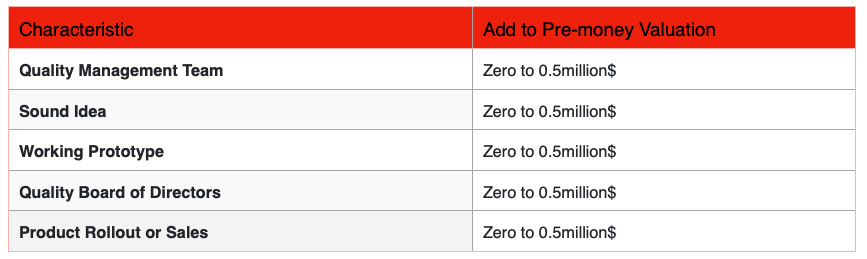

Berkus's Method of Valuation is an early-stage valuation method that was explicitly created to find a starting point without relying upon the founder’s financial forecasts. The Berkus Method studies five crucial areas of a startup and indicates a value ranging from zero to $500,000 for each area. These areas are:

Sound Idea: Eg: $0 – $500,000: The company has an exciting business idea.

Quality Management Team: Eg: $500,000 – $1,000,000: The company has assembled an excellent management team.

Prototype: Eg: $1,000,000 – $1,500,000: The company has a solid product or prototype that attracts customers.

Strategic Relationships: Eg: $1,500,000 – $2,000,000: The company has powerful strategic alliances, partners, or a burgeoning customer base.

Product Rollout or Sales: For eg: $2,000,000 – $2,500,000: The company has signs of revenue growth and a pathway to profitability

The sum of all the values designated results in the pre-money valuation for the startup. The Primary Berkus method had five areas with a maximum of $500k, which led to a theoretical maximum pre-money valuation of $2.5 million.

Thus, an essential modification to the Berkus Method is to adjust the theoretical maximum. This modification is to make it more flexible, both in terms of the areas and the amounts. The area includes the geographical region and the amount is the average valuation for a given startup. For instance, the average valuation for a given startup is $6 million, and then all five areas would get up to 20% of $6M. This would result in $1.2 million each instead of $500k each. The criteria are as follows:

Here the monetary sum of the components is equal to the base pre-money valuation, and we can end up with a pre-money valuation of $0 or $2.5 million based on the chosen amounts. Suppose an entrepreneur wants to use a stand-alone valuation. In that case, it is advised to have a strong knowledge of pre-money valuations of early-stage startup peers per industry, as there are no quantitative factors, or multiple performance numbers to work from. The Berkus method is considered to be an excellent supplement to the Venture Capital Method of pre-money valuation. This is because the Venture Capital Method concentrates heavily on industry quantitative data and forgoes the qualitative factors followed by the criteria mentioned above.

Quantitative vs Qualitative factors

As explained earlier, the main challenge with early-stage company valuation is the lack of revenue numbers and, even if there is a product on the market, it is almost always an MVP. Most methods of evaluating a company rely on revenue and profit projections. However, only very few early-stage startups fulfill or outperform their initial financial projection, which is why quantitative valuation models often do not lead to an accurate result.

The Berkus Method attempts to circumvent the problem of quantifying something, which is not (yet) possible to quantify by using both qualitative and quantitative factors to calculate valuation based on five elements:

Valuable business model (base value)

Available prototype (reducing technology risks)

Abilities of the founding or management team (reducing implementation risks)

Strategic Relationships (reducing market risks)

Existing customers or first sales (reducing production risks)

In the first step, we need to give each of the above-mentioned elements a monetary value. A maximum value that can be assigned to a single element is EUR 500k since that leads to a maximum pre-revenue valuation of up to EUR 2m to EUR 2.5m. The reason for this is that Berkus sets a “soft cap” of EUR 20m valuation in the 5th year of business, giving the investor a ten-times return potential over the investment´s life span.

We prepared a simple calculator, based on the steps of the Berkus Method that showcases an example valuation along key parameters for a fictional early-stage startup. By selecting the different parameters and adjusting the maximum added values you can see how the pre- and post-money valuation changes.

Why Berkus Method?

Most companies do not meet their financial projections and respond to the companies’ poor track record to meet their financial targets. Know that the economic predictions must not rely on startup valuation purposes. The Management assumes that the aggressive revenue growth includes unrealistic profit margins. This is one reason why banks conduct sensitivity analysis to evaluate a company’s repayment capacity and why the Berkus method approaches startup valuation from a risk perspective.

The Berkus valuation method allocates a value to the business idea and the four principal success factors of the company. Each category counts for a maximum of $500,000. The critical value drivers designate risk areas that can make or break the company. These principal risks demand to be managed carefully in case the company is to become successful. The moment a company’s key risks are reduced, the value of the company increases. Therefore, the reduction in risk and valuation of the company go side by side. Berkus’ method is suitable for very young, pre-revenue startups and is not appropriate to value a company with recurring revenue streams.

The Critical Criteria Under Berkus Method

The Critical Criteria Under Berkus Method that you need to understand are given below:

Sound Idea: An idea or a course of action is one thing that every startup begins with. A startup is eventually an idea that is derived from the founder. This idea is considered when it has the potential to solve an unsolved problem. It can also update the current business model of the target industry. One big mistake that a startup performs when validating an idea is massive expenditure. The startup must conduct a final evaluation with a more extended target audience. The startup must check the:

Proprietary nature of the idea – A business idea needs to have the potential to be secured via patents/ copyrights and possess the scope to produce significant returns.

A well-defined plan for the future– Investors have a keen eye on the big picture while investing. Hence, promising startup longevity in a well-planned direction becomes essential.

The scalability of the idea – a scalable business can expand with minimal incremental costs. Thus, for a startup to survive in a competitive market, it must have a scalable idea.

Socio-political relevance – the appeal of the startup idea to the general audience relies heavily on the prevailing socio-political climate. Thus the idea of being relevant is necessary.

Validation of idea – To minimize the risk during the implementation stage, the idea must be subjected to thorough experimentation with a large audience.

Prototype: The prototype is the critical parameter under the valuation of startups by the Berkus method. It is a replica of the actual concept or product to test its viability. The primary notion of prototyping is to face the identified loopholes before any bulk investment such as energy, money, and time. Startups must not underestimate the importance of the prototype, as it proves the functionality of the product. It also acts as a technological risk management technique for startups. Numerous technology risks associated with IT products like breaching confidential data, system/service breakdowns, cyber-attacks, and many more have a bearing on the reputation of a business.

Management valuation: A venture capitalist or angel investor would first check the founder’s domain experience or track record. In case the business founder has achieved a reputation in the domain concerning the startup, it would be of higher weightage in terms of the management’s valuation. This presents a sense of security regarding the management’s efficiency. The running of a team boils down to two words- Good management. Higher the capability of the administration, the higher the valuation.

Strategic relationships: It is said that business is all about relationships, and how well you build them determines how well they do your business. Strategic relationships are defined as collaborations between two or more parties to achieve mutual benefits. A Startup usually enters into strategic relations with huge and well-established parties to exploit their expertise and resources. It is often seen that chains of production/distribution are incomplete in startups and leverage these relationships to ensure smoother rollout/functioning.

Product rollout: Product rollout is the last stage of the development process. It is an imperative factor that defines a startup’s progress or failure. The product rollout depends on the market size in which you will roll it out initially and occur in a limited or global market. It is an internal analysis of the ability of a startup to market and sell its product. The rollout process starts from pre-launch to post-launch activities. The company’s founder must plan a rollout diligently; a product protocol must be made which benefits the target audience. The success of rollout is a signal for the future expansion of the company.

Advantages of Berkus valuation method

The main benefits of the Berkus valuation method are:

The Berkus Method is a straightforward model solely based on qualitative aspects. This makes it a traditional way to value pre-revenue startups. The technique delivers a rough valuation estimate.

To fit your circumstances, you can easily modify the model.

The method makes the user think about corporate governance and risk management topics, such as the company’s strengths and weaknesses, whether the management team possesses the skills and competencies to deliver, how the startup deals with conflicts between the founders, etc.

It provides founders and early-stage investors (business angels, venture capital funds, and crowdfunding backers) with a quick and straightforward valuation method.

Limitations of Berkus valuation method

The main limitations are:

The simplicity of this method is both its strength and weakness. Therefore, founders and investors must realize that the startup valuation has its own limitations. Furthermore, founders and investors have opposing interests while discussing a potential investment deal. Founders seek profit from high valuations, while investors benefit from a low valuation. One can theoretically complete a Berkus valuation exercise within minutes. Nevertheless, it is vital to understand the business risk profile, key risks, and risk mitigants of the company.

The method ignores pitfalls for startups: financial risk. While there is good evidence for this approach, a complete financial plan is still required for any business to assess its capital requirements and better understand its dynamics.

Example

The Berkus model sets the hurdle number at $20M (in the 5th year in business) to:

provide some opportunity for the investment to achieve a ten-times increase in value over its life

Below is an assessment of a fictitious pre-revenue startup. This example illustrates the general rules of the Berkus model:

In the above example, with US $500K as the maximum value per category, I assigned the greatest value to the capabilities of the management team (US $450K) for the founder’s deep domain expertise. Logically, as the investor undertakes a lot of risks, the startup’s management team must be fully capable of achieving long-term success. The startup’s prototype (US $350K) is sound. This minimizes technology risks. Ultimately, this startup achieved a pre-money valuation of approximately US $1.3 million.

Adaptations

Recently, Berkus stated that:

The original matrix is too restrictive, and should be a suggestion rather than a rigid form. The model should allow for higher maximum value on elements not listed in the matrix.

For example, the pre-money valuations might be higher in Silicon Valley than in New York. According to AngelList Valuation Data, the average pre-money valuation in Silicon Valley is $5.1M compared to New York City’s $4.6M. Correspondingly, this model can easily accommodate the altered scenarios.

In Berkus’ own words:

Pre-revenue, I do not trust projections, even discounted projections