BCG Growth Share Matrix

The purpose of BCG Matrix is to make product investment decisions at a strategic level.

What is a BCG Growth-Share Matrix?

It is a portfolio planning method, first developed by the Boston consulting group (founded by Bruce Henderson), that evaluates a company’s strategic business units in terms of market growth and relative market share. It allows companies to see how market share can be expanded in certain markets, while others are reduced. The BCG growth-share matrix is one of the few analytical tools that has been shown to be predictive and useful for investors to do portfolio analysis. It does not require a company’s cash flow or profit as inputs. This means that it can be used by companies with different cash flows and profit margins.

The BCG growth-share matrix can be used to identify and prioritize projects and evaluate the profitability of each product portfolio. It allows companies to understand how their strategic business units’ competitive advantage will impact future profit performance. It can also help them reduce costs, improve productivity, and increase value creation in the long run. Companies that are in the business of providing goods and services can use this tool to understand how they can improve their productivity, efficiency, and profitability.

BCG) Portfolio Matrix

According to this matrix, businesses could be classified as high or low according to their industry growth rate and relative market share. Each of the corporation’s product lines or business units is plotted on the matrix according to both the growth rate of the industry in which it competes and its relative market share. The relative market share serves as a measure of SBU's strength in the market. The market growth rate provides a measure of market attractiveness.

For each product or service, the ‘area’ of the circle represents the value of its sales. The BCG Matrix thus offers a ‘map’ of the organization’s product (or service) strengths and weaknesses, at least in terms of current profitability, as well as the likely cashflows.

The need which prompted this idea was, indeed, that of managing cash flow. It was reasoned that one of the main indicators of cash generation was relative market share, and one which pointed to cash usage was that of market growth rate.

Relative Market Share = SBU Sales this year leading competitors’ sales this year.

This indicates likely cash generation because the higher the share the more cash will be generated. As a result of ‘economies of scale’ (a basic assumption of the BCG Matrix), it is assumed that these earnings will grow faster the higher the share. The exact measure is the brand’s share relative to its largest competitor. Thus, if the brand had a share of 20 percent, and the largest competitor had the same, the ratio would be 1:1. If the largest competitor had a share of 60 percent, however, the ratio would be 1:3, implying that the organization’s brand was in a relatively weak position. If the largest competitor only had a share of 5 percent, the ratio would be 4:1, implying that the brand owned was in a relatively strong position, which might be reflected in profits and cash flows. If this technique is used in practice, this scale is logarithmic, not linear.

The reason for choosing relative market share, rather than just profits, is that it carries more information than just cash flows. It shows where the brand is positioned against its main competitors and indicates where it might be likely to go in the future. It can also show what type of marketing activities might be expected to be effective.

Relative Market Share = Sales This Year / Leading Rival’s Sales This Year

Market Growth Rate = Industry sales this year — Industry Sales last year

Market share is the percentage of the total market that is being serviced by a company under consideration, measured either in revenue terms or unit volume terms. Higher the market share, the higher the proportion of the market one controls. The Boston Matrix assumes that if the company under consideration is enjoying a high market share then it will be making more money. (This assumption is based on the idea that the company has been in the market for long enough to have learned how to be profitable, and will be enjoying scale economies that give an advantage). Market growth is used as a measure of a market’s attractiveness. Markets experiencing high growth are ones where the total market is expanding, meaning that it’s relatively easy for businesses to grow their profits, even if their market share remains stable. While, competition in low-growth markets is often bitter, and while you might have a high market share now, it may be hard to retain that market share without aggressive discounting.

The analysis requires that both measures be calculated for each SBU. The dimension of business strength, and relative market share, will measure the comparative advantage indicated by market dominance. The key theory underlying this is the existence of an experience curve and that market share is achieved due to overall cost leadership.

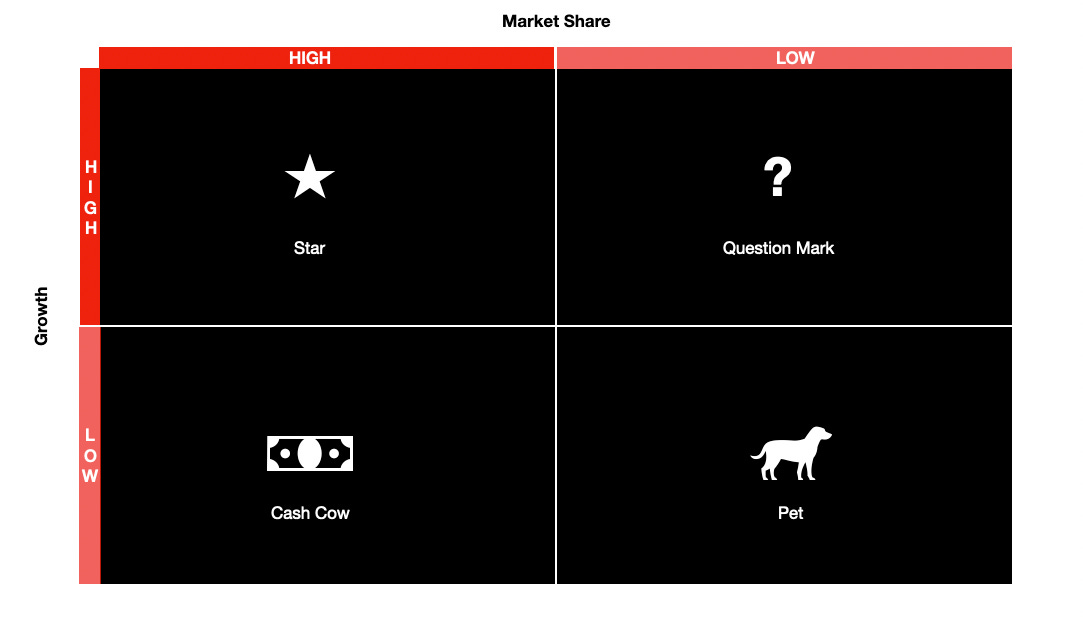

BCG matrix has four cells, with the horizontal axis representing relative market share and the vertical axis denoting market growth rate. The mid-point of relative market share is set at 1.0. if all the SBUs are in the same industry, the average growth rate of the industry is used. While, if all the SBUs are located in different industries, then the mid-point is set at the growth rate for the economy.

Resources are allocated to the business units according to their situation on the grid. The four cells of this matrix have been called stars, cash cows, question marks, and dogs. Each of these cells represents a particular type of business.

Stars – Stars are high-growth businesses or products competing in markets where they are relatively strong compared with the competition. They are typically at the peak of their product life cycle. Stars generate large amounts of cash because of their strong relative market share, but also consume large amounts of cash because of their high growth rate. Often they need heavy investment to sustain their growth. Eventually, their growth will slow, and will become cash cows.

Cash Cows – Cash cows are low-growth businesses or products with a relatively high market share. These are mature, successful businesses with relatively little need for investment. They typically bring in far more money than is needed to maintain their market share. In this decline stage of their life cycle, these products are “milked” for cash that will be invested in new question marks.

Question marks – Question marks are businesses or products with low market share but which operate in higher growth markets. Question marks are growing rapidly and thus consume large amounts of cash, but because they have low market shares they do not generate much cash. A question mark (also known as a “problem child”) has the potential to gain market share and become a star, and eventually a cash cow when the market growth slows. If the question mark does not succeed in becoming the market leader, then after years of cash consumption it will degenerate into a dog when the market growth declines. Management has to think hard about “question marks” – which ones should they invest in? Which ones should they allow to fail or shrink?

Dogs – Dogs have a low market share and a low growth rate and thus neither generate nor consume a large amount of cash. However, dogs are cash traps because of the money tied up in a business that has little potential. Such businesses are candidates for divestiture.

The Boston Consulting Group(BCG) Portfolio Matrix's simplicity is its strength – the relative positions of the firm’s entire business portfolio can be displayed in a single diagram. Its limitation is market growth rate is only one factor in industry attractiveness, and relative market share is only one factor in competitive advantage. The BCG growth-share matrix overlooks many other factors in these two important determinants of profitability.

Benefits of BCG Matrix

Organizations that are very large such that they require setting up business units usually face the test of the allocation of resources among those business units. The BCG matrix was developed for the management of various business units.

The BCG is an effective management tool and it offers a good framework for resource allocation among various units. This enables the managers to compare several business units whenever they want. It simplifies many business factors by showing employees the market share as well as growth rate and how to use them to create new strategies.

Even though the BCG matrix may be among the oldest matrices ever formulated, it is also the most common and best-known matrix taught all over the world. There are forums on the internet where individuals share their ideas on the best methods of using the BCG matrix because of its popularity. This means that those looking to use it will never lack assistance and support. The BCG still remains a quick and beneficial guide for resource allocation and ensuring better profits.

The BCG allows for the making of comparisons so as to measure the growth and development rate of a company against the average growth rate in that specific industry. In addition, this particular matrix is also enjoyable to use, encouraging better decision-making.

How Does the Growth Share Matrix Work?

The growth share matrix was built on the logic that market leadership results in sustainable superior returns. Ultimately, the market leader obtains a self-reinforcing cost advantage that competitors find difficult to replicate. These high growth rates then signal which markets have the most growth potential.

The matrix reveals two factors that companies should consider when deciding where to invest—company competitiveness, and market attractiveness—with relative market share and growth rate as the underlying drivers of these factors.

Each of the four quadrants represents a specific combination of relative market share and growth:

Low Growth, High Share. Companies should milk these “cash cows” for cash to reinvest.

High Growth, High Share. Companies should significantly invest in these “stars” as they have high future potential.

High Growth, Low Share. Companies should invest in or discard these “question marks,” depending on their chances of becoming stars.

Low Share, Low Growth. Companies should liquidate, divest, or reposition these “pets.”

As can be seen, product value depends entirely on whether or not a company is able to obtain a leading share of its market before growth slows. All products will eventually become either cash cows or pets. Pets are unnecessary; they are evidence of failure to either obtain a leadership position or to get out and cut the losses.

Limitations of BCG Matrix

The BCG Matrix produces a framework for allocating resources among different business units and makes it possible to compare many business units at a glance. But BCG Matrix is not free from limitations, such as;

BCG matrix classifies businesses as low and high, but generally, businesses can be medium also. Thus, the true nature of the business may not be reflected.

The market is not clearly defined in this model.

High market share does not always lead to high profits. There are high costs also involved with high market share.

Growth rate and relative market share are not the only indicators of profitability. This model ignores and overlooks other indicators of profitability.

At times, dogs may help other businesses in gaining a competitive advantage. They can earn even more than cash cows sometimes.

This four-celled approach is considered to be too simplistic.

🔥 Top three quotes from our Instagram page

A good leader takes a little more than his share of the blame, a little less than his share of the credit. - Arnold H. Glasow

People rarely buy what they need. They buy what they want. – Seth Godin

Make it simple, But Significant - Don Draper