26/36 : 🚀📝 Product Pitch Deck Framework

Build something that a small number of users love rather than a large number of users like

What is a Pitch Deck?

A product pitch deck is made up of several slides that let you quickly and clearly communicate the idea and potential of your startup.

A pitch deck doesn’t delve into the minute details of the startup like a business plan; instead, it provides a top-level overview of the business with the goal to be clear and concise rather than comprehensive.

A pitch deck generally includes the following slides:

Introduction

Problem

Solution

Market

Product

Validation and/or Traction

Team

Competition

Financial projections

The Ask

What is the Purpose Of a Startup Pitch Deck?

A startup pitch deck is a presentation that can be used to raise funds, explain and refine concepts, recruit co-founders, gather feedback, hire early team members, and secure strategic alliances.

What to Include in a Pitch Deck?

The structure of a pitch deck is one of the most important aspects to get right.

It’s usually a very bad idea to try to be overly creative with it when learning how to make a pitch deck. Most startup investors go through a very large amount of decks.

Because of this, they have a checklist that helps them select the projects that fit their investment profile best and to weed out the bad matches as fast as possible (on average, investors spend just 3 minutes and 44 seconds on a pitch deck).

This means that it is in your best interest to cover all the topics that investors expect to see. If you have a weird structure, you risk hitting fewer checkboxes on the list, in which case the investors won’t have a reason to consider your project more closely.

The keys to a successful pitch deck are:

To present your idea as clearly and concisely as possible.

To differentiate your idea from other startups.

To convince your audience of the high potential and high chances of success of your idea.

Each slide should be created with these three principles in mind.

Here are the 10 key topics we will cover in this pitch deck guide ":

Slide 1: Introduction

Goal: To communicate extremely clearly and concisely what your business is offering.

In a way, this is the most important slide in this pitch deck guide because it establishes the first impression. After seeing it, your audience should have no doubt in their mind what your business is about.

“Book rooms with locals, rather than hotels.”

The sentence “Book rooms with locals, rather than hotels.” lets the audience comprehend the offering of the business in a few seconds.

“Airbnb is disrupting the worldwide hospitality industry by allowing business and leisure travelers to book their accommodation in privately-owned residential properties rather than hotels.”

First, the main point of this slide is to present the offering – what does the company do? Talking about your ambitions (disrupting the hospitality industry) dilutes the information on the slide and takes the attention away from the main point.

Second, it’s extremely important to be economical with words. During a presentation, the audience would have mere seconds to glance at the slides, so lengthy sentences simply wouldn’t be read. This is true throughout the whole presentation, but it is especially true for slides on which you’ll spend a short time while presenting, like the intro slide.

Third, some people are used to industry-specific lingo, but some are not. Confusing even a small percentage of your audience isn’t worth it – your future investor might be a person in this group, and you risk losing them. Using industry lingo makes you sound competent, like an insider, which is worthwhile when you talk to other people in the industry. A fundraising pitch deck, however, isn’t aimed at insiders. A large percentage of potential investors would come from different industries, and some of them wouldn’t even be familiar with startup lingo. They would often judge your company from the standpoint of a potential customer, rather than an industry insider. So – use as little lingo as possible. You should strive to make the presentation perfectly understandable to an average Joe.

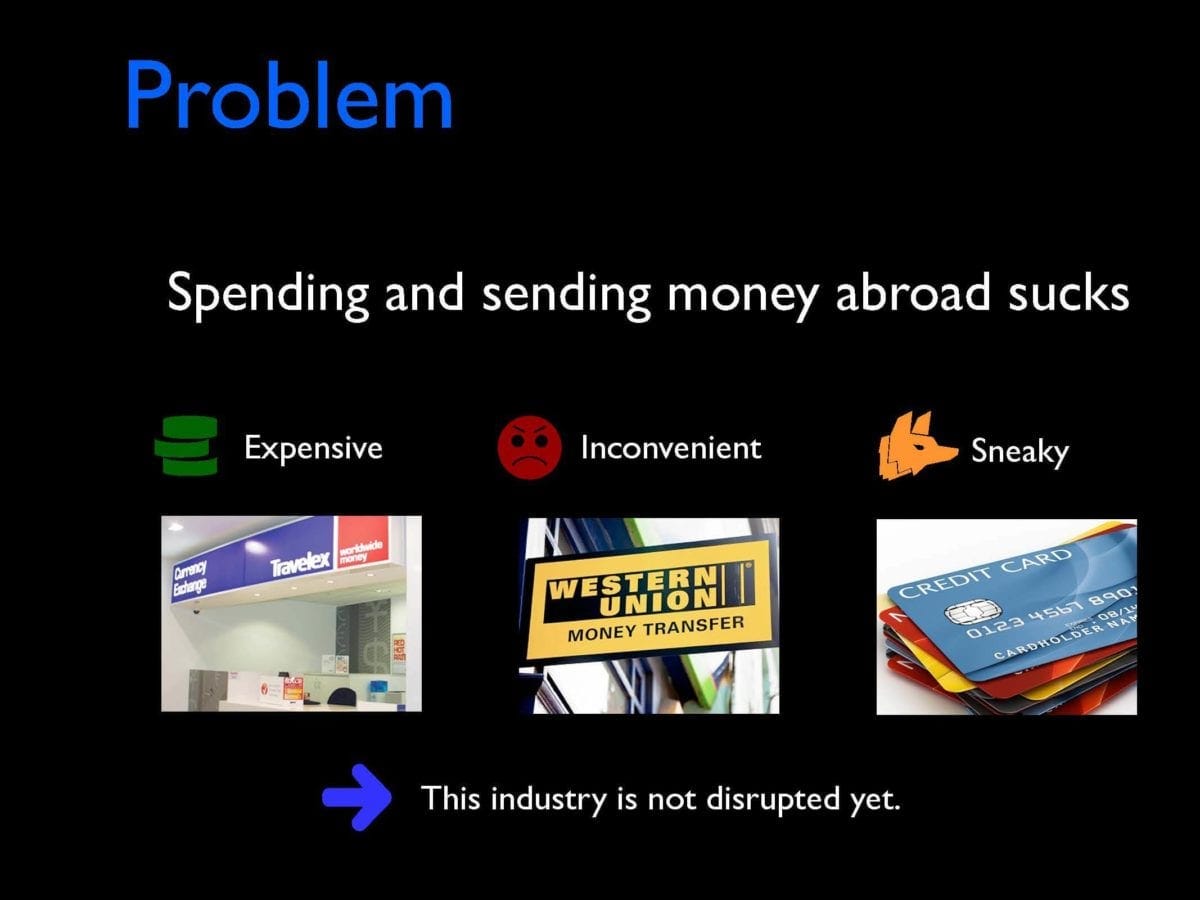

Slide 2: Problem

Goal: To convince people you are solving a real, acute pain.

This is a vital part in learning how to make a pitch deck as the number one reason for startup failure is the lack of product-market fit. In other words, you are building something that nobody is willing to pay for.

The job of this slide is to convince your audience that this is not the case. This means the people you are presenting to need to empathize with your target customer. They need to understand the problem rationally, but also emotionally.

How you achieve this is case-specific. A good example of doing this efficiently is Nikolay Storonsky – he tells the story of how he got annoyed by currency conversion and transfer fees when he was traveling abroad one time, which motivated him to create Revolut. This way he is not presenting a theoretical problem but is telling a real story that is easier to empathize with.

Of course, this is not the only approach you can take. It’s also a viable strategy to focus on data and to let the facts make your case for you.

A great tip regarding the problem is to focus: solve one problem, rather than many. First, a pitch deck usually doesn’t give you enough time to talk about multiple problems. Second, solving a single problem is hard enough, and early-stage startups shouldn’t spread their resources too thinly. It’s much better to solve one problem well, rather than to solve 10 problems badly.

Keep in mind that the ideal early-stage startup addresses a single problem for a single type of customer with a highly scalable single-feature solution. Complexity is a big drawback at this stage.

Slide 4: Market

Goal: To convince your audience that the project has an extremely high upside.

Startups = growth. The risky nature of innovative, disruptive businesses means that for the investment to be worthwhile, the upside in case the project is a success needs to be big enough.

A general rule of thumb is that the startup should have a realistic chance to return the initial investment 100x as a bare minimum. This is because one winning investment needs to compensate for at least 9 unsuccessful projects. Moreover, the investors usually have a minority share of the business that gets diluted by further investment rounds. This means that e.g. a 10% stake in the business should be valuable enough to pay for the losses from other projects with a sizable return on top of that.

Consequently, the market should be big enough. Use data to present a believable (albeit big enough) number for the total available market, the serviceable market, and then calculate the value of your venture in the best-case scenario e.g. by using a realistic market share.

For example, in Airbnb’s original pitch deck, they aimed for 84M booked trips from their platform from 560M budget and online trips worldwide, which results in a yearly revenue of $2.1B and suggests a business value north of $20B. While these numbers seem audacious for an early-stage startup, their best-case-scenario numbers turned out to be conservative – at the time of writing this, the market cap of Airbnb is $88B, and their revenue is north of $4B.

Slide 5: Product

Goal: To demonstrate your product.

While the solution slide focuses more on your offering and value proposition, the product slide needs to give your audience a good idea of what you’re building.

Doing a live demo is a possibility, but it’s only viable if you have enough time. That said, even if you cannot do a demo, including visual representations of your product is a good idea (screenshots, mockups, prototypes, etc.).

In this slide, you can name the key features of your product, but don’t go in-depth. Remember that this is a high-level overview, and keep in mind that features change often when customer feedback demands it.

Including some (real and positive) customer feedback about the product is a good idea, because it could serve as a great sеgue to the next topic, which is validation and traction.

If you are doing a very short presentation, you could merge the solution and product slides, as they have a similar purpose.

Slide 6: Validation and/or Traction

Goal: To give evidence of problem-solution or product-market fit.

Nowadays startup investors are more sophisticated, so it would be hard to attract real interest without presenting any form of empirical evidence. They are aware that most early-stage startups fail because they are building something the market doesn’t need.

If you manage to ace this part of the presentation, you can be sure you’ll attract the attention of investors and potential partners.

In order to do this well, however, you’ll have to do work before creating the pitch deck. In the very early stages of your venture, this usually means running idea validation experiments. After you launch the first version of your product, it means measuring your traction, growth, and ideally choosing a KPI that is a good leading indicator of product-market fit.

If you have done this work and done it well, and if the evidence suggests that you are moving in the right direction towards PMF, all you need to do in this slide is to present this as clearly as possible.

If you are making a long presentation and time isn’t pressuring you, it’s a good idea to present multiple metrics that speak favorably of your business. If you are making a short pitch, however, it’s best to concentrate on one or two metrics at the most.

Ideally, this would be month-over-month growth (keep in mind that programs like Y Combinator expect 15% of month-over-month growth) in financial terms and in usage terms. You should choose an appropriate usage KPI so that it points strongly towards PMF.

Slide 7: Team

Goal: To leave your audience with the impression that you are the right people for the job.

It’s a common saying that a tech startup needs a hacker, a hustler, and a hipster.

While the hipster (a.k.a. designer) is negotiable in some startups, the hacker and hustler rarely are.

Investors are looking for the right amount of technical skills and knowledge combined with marketing drive and acumen in your team, and if they don’t find it, this worries them.

In order to make this slide effective, you should get to the point as directly as possible. What experience do your team members have that proves they have the necessary skills?

If the credentials of your team aren’t impressive (e.g. you founded the startup in college), then make sure to attract at least one mentor before you attempt to fundraise who was a lot more experience in your field and ideally – in startups. This way the presence of the experienced mentor will alleviate the fears that the inexperienced founding team awakes in investors.

Keep in mind that how you carry yourself would complement the impression that this slide makes. Investors are people and they prefer working with founders who they like. Being friendly while showing confidence and competence is key.

Slide 8: Competition

Goal: To present other players in your market and to clarify your competitive advantages.

Don’t make the mistake that no competition is a good indicator. On the contrary, claiming there are no competitors in the market tells investors two things:

Either you haven’t done proper market research, or there is no need for what you are building – hence the lack of businesses with a similar offering. Both of these options are deal-breakers.

Instead, try to find your biggest competitors and clearly explain how your offering is different, and why you have a competitive advantage. A comparison table is a typical way to achieve this quickly and efficiently.

Moreover, keep in mind that investors are herd animals and the fear of missing out is a leading force in the startup investment landscape. Having other startups in your industry who are managing to raise funds at high valuations and who are growing rapidly helps you take advantage of this force.

Crunchbase is a great resource for finding this information. Keep in mind that fundraising info on other startups can be used in your favor in future negotiations with investors.

Slide 9: Financial projections

Goal: To present a favorable financial trajectory of the business.

Having an excel table of financial projections (revenue + costs) is extremely important, especially if your startup is already generating revenue. A lot of investors expect to see it once you’ve started talking in more detail.

In the pitch, of course, it’s best to visualize the financial information through charts.

Most investors expect 3 to 5 years of projections as it helps them judge the cost structure of the business, its potential, and how grounded the founding team is.

While a lot of people would say the worst thing that could happen is to over-promise and under-deliver, a worse thing is not to attract any investors because your projections are too low. Because of this, it’s important to strike a balance. Stay as grounded in reality as possible, while at the same time accounting for the fact that startup investors are looking for potential unicorns.

Exponential growth is the key that usually allows you to strike this balance. Be conservative in the short run, but let the compounding of a good month-over-month growth let you achieve big numbers in the long run.

Keep in mind that people usually overestimate how much can be done in a day, week, or month, but severely underestimate how much can be done in 5 years. Don’t let yourself fall into that trap.

Last but not least, if you are a very early-stage startup, this slide isn’t that important. If you are still in the process of creating a working product and finding product-market fit, it’s clear to all investors that financial projections are useless. It’s better to show a high upside potential in the market slide.

Slide 10: The Ask

Goal: What are you willing to achieve with this presentation?

How much money are you willing to raise (include a range rather than a specific number, and you might include stages), at what valuation, and what are you going to do with the money? How long is it going to last you and what will you do once this period runs out (usually, this means either running an additional funding round (the common option) or achieving self-sufficiency)?

In case you are not fundraising but are looking for partners or team members, you need to let the audience know of your exact goals and circumstances.

Slide X: Additional Slides

Goal: To give important information that doesn’t fit neatly into one of the traditional slides

Exit Strategy: Acquisition by X company, IPO, etc. Talking about this too early is unnecessary, but if you are a late-stage startup it’s not a bad idea to pave the way for a potential exit.

Strategic Partnerships: Display any strategic partners that you have and that increase your chance of succeeding.

Business Model: This information should be included in the product, traction, or finance slides, but in case you haven’t done so – you can make a slide of its own. How your business makes money is an important question to answer, especially in the early stages of the project.

Other Investors: They present social proof and validates the project in the eyes of the investors.

Advisors and mentors: Usually included in the team slide. If you have more, you can dedicate a separate slide. Very important if the founding team is inexperienced.

The Do’s and Don’ts of a Startup Pitch Deck

Pitch Deck Dos:

Use a large font and exclusively short information-dense sentences.

Use bullet points, don’t write whole paragraphs. The text on the slides is meant to provide key info and structure.

Use narrative – it’s easier to keep the audience engaged if you’re telling stories rather than presenting dry facts. That said, it’s easier to do this when you have more time. In a two-minute presentation, you might be restricted in this regard.

Use pictures and other visuals (charts, graphical elements, etc.). The advantage of visual info is that it can communicate information at a glance.

Add contact details on the first or last slide.

Use slide-show templates on services like Canva. This helps you create a visually coherent and good-looking pitch deck. In 2022, the expectation is higher than it was 10 years ago, as design tools are much more accessible. This is especially important if you don’t have a designer in the team who can do this for you from the ground up.

Exercise making the pitch in front of people – it’s crucial that you present fluently and you can deal well with time restrictions at pitching events.

Pitch Deck Don’ts:

Add too much information on the slides. There’s no time to read it all during a presentation.

Use a unique and creative structure. The audience expects certain information, you have to give it to them as clearly as possible.

Go off on tangents while presenting. It’s not a conversation, it’s a presentation.

Add too many details for a single topic. Time constraints you, and it’s better to focus on the most important pieces of information in a bit more depth, rather than to list a lot of things without covering them at all. A good example of this is including too many team members on the team slide in case you are a later-stage startup.

Startup Pitch Deck Examples

You can browse our pitch deck database to get hundreds of great examples. You can filter the pitch deck examples by industry, business model, and startup stage to see the pitch decks of the successful companies in your industry when they were at a similar developmental stage as your business.

Coinbase: The best aspect of this pitch deck is how well it presents the product visually while contrasting it with the current inferior solutions. While crypto and blockchain are technologically intimidating industries, the pitch deck makes it very accessible by presenting the problem and solution as simple as possible.

Uber: Showcases how a very rudimentary-looking pitch deck of a very early-stage startup can do the job just fine – it resulted in a successful pre-seed round of $200k.

Dropbox: A bit more lengthy example (not ideal for 2-5 min presentation), but it does an exceptional job of explaining the problem/solution, why the market timing is right, and even comparing the market opportunity to another success story – search pre-Google. The pitch managed to raise a $1.2M seed round, so it definitely caught the attention of investors.

Documentation to Send after a Pitch Deck

If the pitch deck is the trailer to the movie, then it follows that people need to be able to see the whole movie if they are interested.

This usually means follow-up conversations, and you can make a great impression if you have further documentation to send to the people you’re talking to. Just sending the pitch deck (especially if it’s a short one) is rarely enough.

Lean Canvas: A whole detailed business plan (30+ pages) is rarely used for early-stage startups because it takes a lot of work to produce while the nature of early-stage startups necessitates that it’s going to change a great deal every time customer feedback forces you to iterate. Because of this, you can send a lean canvas - the so-called one-page business plan.

Business Plan and Executive Summary: A detailed business plan becomes more important once your startup is at a stage at which the direction is clear, as it gives more details about the strategy and execution which are likely to hold at least in the mid-run. It’s a good idea to accompany the full business plan with an executive summary – summarizes the key points of the plan for people that aren’t interested enough in the business to read a whole 30+ pages document.

Technical documentation: For high-tech startups, investors would usually want to verify your claims with a technical expert, so you should be ready to showcase what you’re doing and how.

Financial documentation: An excel sheet displaying your revenue and cost structure and giving 3 to 5-year projections is very useful to have ready in case people ask for details about your finances.